A Local Perspective on Our State’s Economic Wake-Up Call

About two years ago, economist Eric Fruits, Ph.D., and his wife experienced a tragedy in their own neighborhood. While out for her early morning walk, his wife found their neighbor, the school custodian who worked across the street, dead on the sidewalk. “Had she been there just a few minutes earlier, she might have called 911,” Fruits told a room of Salem business and community leaders at the Salem Area Chamber of Commerce Forum Lunch. “She might have even tried her hand at CPR. But it was too late.”

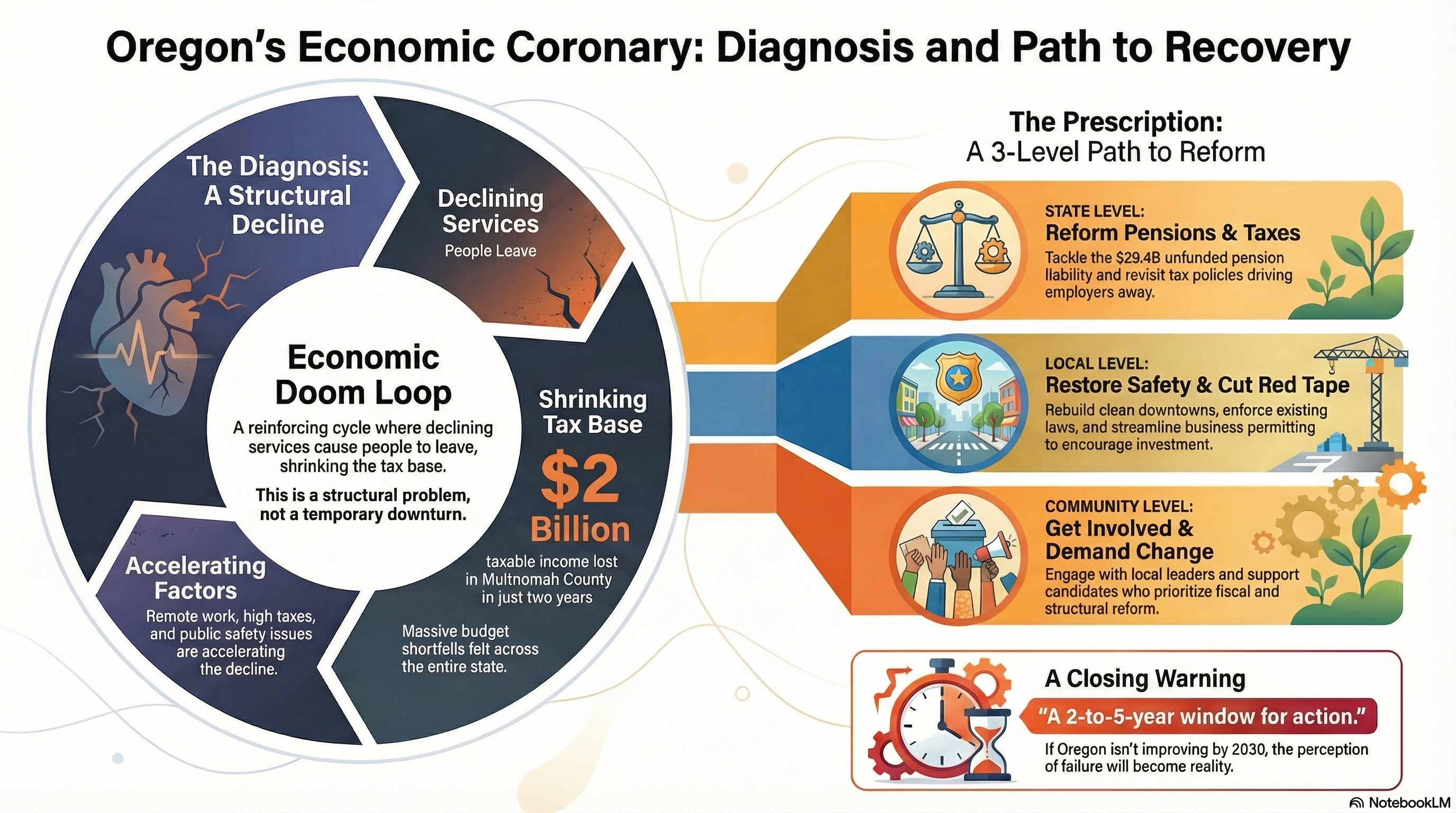

Dr. Fruits opened with that story to deliver a sobering metaphor. Oregon, he said, is in a similar condition. “We are suffering what I would call an economic coronary. It’s a devastating cascade of fiscal, policy, and demographic failures that are reinforcing each other.” His message was clear and urgent. The state still has a pulse, but time is running out to take action.

At a Glance

- Speaker: Eric Fruits, Ph.D., economist and policy analyst

- Topic: Oregon’s growing economic challenges and the risk of long-term decline

- Key Concern: Oregon is facing what Fruits calls an “economic coronary,” caused by high taxes, poor policy decisions, and a shrinking tax base

- Portland’s Impact: Although Portland holds less than half the state’s population, it generates more than half of Oregon’s tax revenue. Its decline affects every community in Oregon

- Urgent Issues: Job losses, collapsing commercial property values, public pension debt, and the ongoing effects of remote work

- Call to Action: Oregon has two to five years to show progress through pension reform, tax restructuring, downtown revitalization, and bold local leadership

- Quote to Remember: “Oregon still has a pulse. We can still call 911. We can still perform CPR. But if we just walk past this crisis… we will find ourselves standing over a body that is too late to save.”

Why Portland’s Challenges Matter Across Oregon

While much of Fruits’ data focused on Portland, he made clear that the implications extend far beyond the city. “The economic health of Portland is crucial to Oregon,” he said. Multnomah County represents only 19 percent of the state’s population but contributes a quarter of Oregon’s tax revenue. As businesses and residents leave the region, the resulting budget shortfalls are felt across the state, including in Salem.

In just two years, Multnomah County lost more than 2 billion dollars in taxable income. Portland’s commercial property values are collapsing, including an 88 percent drop in the sale price of the U.S. Bancorp Tower. Fruits noted that these losses are creating a wave of property tax appeals and long-term funding gaps for local governments.

The “Doom Loop” and Why It Matters

Fruits used the concept of a “doom loop” to describe the self-reinforcing cycle of decline that threatens cities and states.

- Services decline.

- People and businesses leave.

- The tax base shrinks.

- Budgets are cut further.

- Services decline again.

“Normal policy prescriptions don’t work anymore,” he warned. “Tweaks don’t work anymore.” The symptoms are visible in places like Portland, but the cause and effect can be found throughout Oregon.

Remote work is accelerating this dynamic. With fewer workers commuting into cities, businesses that rely on foot traffic suffer. Downtowns become emptier, retail demand falls, and commercial vacancies grow. All of this weakens the local tax base and makes public safety and livability challenges more difficult to address.

What This Means for Salem and Other Local Communities

Though Portland draws the headlines, communities across Oregon face similar trends. Salem and other cities are managing the same mix of post-pandemic realities: rising public pension costs, reduced downtown activity, and pressure on small businesses.

Fruits emphasized that these conditions are not part of a normal cycle. “This is a structural problem. It is not cyclical. It is not a rough patch we just have to get out of. This is something bigger than that.”

The Role of High-Income Earners and Business Flight

Eric Fruits emphasized how dependent Oregon’s tax structure has become on a relatively small number of high-income earners. According to state tax data he cited:

- The top 5 percent of Oregon tax filers pay about 40 percent of all income tax revenue

- The top 1 percent, approximately 24,000 households, pay nearly 25 percent of the state’s total income taxes

- If just 250 of those households, one percent of the top one percent, were to leave Oregon, the state would lose an estimated 27.5 million dollars annually in tax revenue

“These households are not just wealthy individuals,” Fruits explained. “They are often business owners, job creators, and major supporters of public services through their tax contributions.”

Fruits also spoke about the growing incentive for businesses, both large and small, to leave Portland or the state altogether. He gave examples of companies like Dutch Bros relocating their headquarters, and described how firms across sectors are quietly moving operations to Clark County or other lower-tax areas, often without making headlines.

“The Dutch Bros and the Intels, those are the tip of the iceberg,” he said. “What you’re missing are thousands of other stories underneath it.”

The Role of Small Businesses in Oregon

While not specifically addressed in the presentation, it is important to note that small businesses make up 99.4 percent of all businesses in Oregon and employ about 54 percent of the private workforce, according to the U.S. Small Business Administration. These businesses include sole proprietors, local retailers, professional service firms, and startups. Many are especially sensitive to rising taxes, regulatory burdens, and downtown instability.

As Oregon’s tax base continues to shift, and as business flight accelerates, the health of these small employers will play a critical role in the state’s long-term economic recovery.

A Path Forward

Despite the stark data, Fruits was clear that Oregon is not past the point of no return. He outlined several critical reforms that could help the state recover, stabilize local budgets, and rebuild confidence.

At the State Level:

- Public pension reform is essential. Oregon’s Public Employee Retirement System (PERS) has a $29.4 billion unfunded liability. Fruits called it a “911 emergency.”

- Revisit tax policies. High personal and business income taxes are driving away employers and top earners. Fruits noted, “We are losing about a billion dollars a year in Multnomah County alone to tax competition.”

- Simplify housing and construction rules. Delays, fees, and overly complex regulations are slowing development and deterring investment.

At the Local Level:

- Rebuild safe and clean downtowns. Without visible improvements, residents and businesses will not return.

- Enforce existing laws. This includes removing unauthorized camps, prosecuting vandalism, and shutting down open-air drug markets.

- Streamline permitting and cut red tape. Make it easier for small businesses and developers to invest locally.

At the Community Level:

- Get involved and speak up. Fruits said, “Stop pretending it’s someone else’s problem.” Join your Chamber of Commerce, contact your local representatives, and demand results.

- Support candidates and leaders who prioritize fiscal and structural reform.

- Choose to stay and lead. Oregon needs strong voices to shape the future.

A Narrow Window

Fruits warned that Oregon has just a few years to demonstrate a real turnaround. “We have about two to five years to show that we are actually serious about turning things around. If we don’t have things ticking upward again by 2030, the perception that the city and the state are failing will harden into a reality.”

For Oregon to recover, community leaders must act decisively. For residents, the challenge is to stay engaged and informed. For policymakers, the moment calls for courage, not caution.

Fruits concluded his presentation by returning to the real-life tragedy he shared at the beginning. “Oregon still has a pulse. We can still call 911. We can still perform CPR. But if we just walk past this crisis we will find ourselves standing over a body that is too late to save.”

FAQs

1. Who is Eric Fruits, Ph.D.?

Eric Fruits is a Portland-based economist and policy analyst. He has written extensively on state and local economic issues and regularly speaks to business and civic groups about Oregon’s fiscal health and policy challenges.

2. What is the “doom loop” Eric Fruits referred to?

The “doom loop” is an economic concept describing a self-reinforcing cycle of decline. As services deteriorate, residents and businesses leave. That reduces tax revenue, which leads to more service cuts, prompting further departures.

3. How does Portland’s decline affect cities like Salem?

Although Portland is only part of the state, it generates a significant portion of Oregon’s tax revenue. When Portland loses businesses and income, state budgets shrink, which affects education, infrastructure, and services statewide.

4. What is PERS, and why is it a problem?

PERS stands for the Public Employees Retirement System. It currently has a $29.4 billion unfunded liability, placing increasing financial pressure on state and local governments, including school districts and city services.

5. What can local business owners and residents do?

Get involved in civic organizations like the local Chamber of Commerce, attend city and legislative hearings, contact your elected representatives, and support policies or leaders focused on long-term fiscal reform and economic stability.