Community Spotlight: Ozark Merchant Services LLC

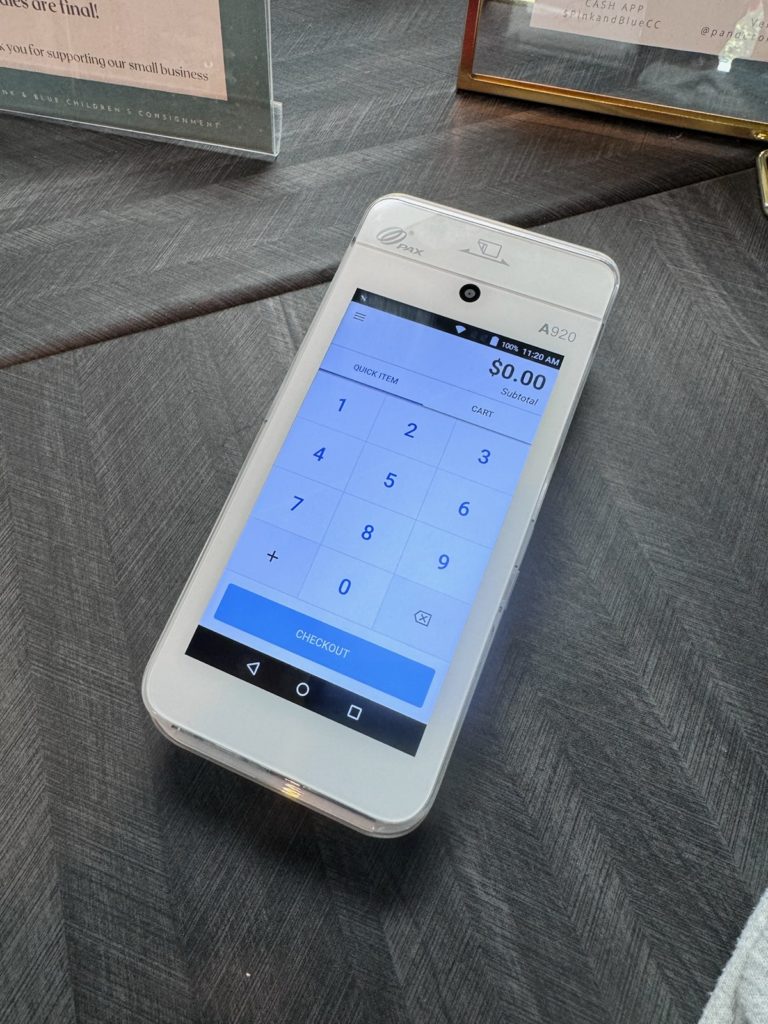

Photo credit: Cole Herron

Starting a business is no easy feat, but for Cole Herron, the difficulties of his first failed venture became a powerful lesson in perseverance, resourcefulness, and financial strategy. After struggling with unsustainable costs and the complexities of payment processing, Herron turned his experience into an opportunity, founding Ozark Merchant Services to help other small business owners avoid the same pitfalls.

As a veteran, entrepreneur, and local business advocate, Herron understands the unique challenges many face when it comes to balancing overhead costs, making a profit, and handling the lesser-known details like payment processing fees. “I was getting raked over the coals,” he said, reflecting on his first business, where he found himself constantly losing money due to costly online payment processing. “I wasn’t making enough to cover both the payment processing and product costs.”

For Herron, that painful experience turned out to be the foundation of his future success. Determined to find a solution, he dove headfirst into learning how payment systems worked. His drive to solve his own problem evolved into a passion for helping other small business owners navigate a world that’s often confusing and filled with hidden costs. That’s how Ozark Merchant Services was born—a company built on helping businesses save money and run more efficiently through transparent, personalized payment processing solutions.

Photo credit: Cole Herron

Before founding Ozark Merchant Services, Herron’s first business venture involved selling products online with the goal of raising money for military charities. A veteran himself, Herron had a deep desire to give back to his community, especially to other veterans. However, the costs associated with online transactions quickly overwhelmed the fledgling business. “One of the things killing me was the payment processing because of the way I was doing it—online through my website,” Herron explained.

Despite his best efforts, Herron realized that his business wasn’t going to survive under the weight of those processing fees. It was a tough reality, but one that eventually led him down a new path. That search for answers sparked his interest in how payment processing works, and soon he began to see a new opportunity—helping other business owners who were in the same position.

“I started liking the business in and of itself—how it works,” Herron shared. He became fascinated by the payment processing industry, learning everything he could about how businesses are charged, where hidden fees come from, and, most importantly, how they could be reduced or eliminated altogether. Today, Ozark Merchant Services offers solutions specifically tailored to help businesses avoid the same struggles Herron faced in his early days.

One of the key elements that sets Ozark Merchant Services apart is Herron’s belief that payment processing isn’t a one-size-fits-all solution. “When I come in, I try to figure out how the business operates, what they sell, and where they sell—whether it’s online, in person, or both,” he explained. Whether a business operates primarily online, in person, or both, Herron takes the time to understand their specific needs and then customizes a plan to optimize their payment processing.

Herron conducts a “cost savings analysis” (CSA) for each business, where he thoroughly examines the business’s current credit card processing fees and identifies areas for improvement. This detailed breakdown allows him to pinpoint unnecessary fees and offer better, more cost-effective alternatives. “A lot of times, there’s hidden stuff that payment processors slip in. If you don’t know to look for it, you wouldn’t even notice,” he explained.

This transparency is at the heart of Herron’s business philosophy. Rather than locking his clients into complicated contracts with hidden clauses, Ozark Merchant Services operates with no long-term contracts and no leasing agreements for equipment. “If I’m doing a terrible job, you can kick me to the curb. No problem. There’s no contract with me,” Herron said with a laugh. For Herron, building trust with his clients is more important than squeezing out every dollar. “What I consider my job is to inform the business owner where they sit,” he added.

Photo credit: Cole Herron

One of the most effective strategies Herron employs for reducing payment processing costs is a system called dual pricing. This program allows businesses to eliminate processing fees by passing a small percentage of the cost to the customer, essentially offering two prices—one for customers paying with cash and another for those using cards. “If you go to pretty much any bar, you’ll see something that says credit card transactions have a small fee. That’s dual pricing,” Herron explained.

For businesses with smaller transactions, like restaurants or bars, dual pricing can save them thousands of dollars each year without significantly impacting customer satisfaction. If a business does a lot of small transactions, around $15 to $25, that extra 3.5% isn’t enough to make customers upset, but it could save the business hundreds or thousands a month, Herron explained.

In fact, one of Herron’s most notable success stories involves a local store that was paying over $1,500 a month in processing fees. After working with Ozark Merchant Services, the store was able to reduce those fees to just $20 a month by implementing dual pricing. “That’s what the dual pricing can do—it can change that massive amount of money they’re losing to the bank into money they can reinvest into their business,” Herron said.

Herron’s success in saving businesses money is a testament to his dedication and expertise. His approach isn’t just about reducing fees—it’s about helping businesses stay afloat, reinvest in their operations, and ultimately thrive.

Herron’s dedication to helping businesses doesn’t stop at the numbers. One of the core values of Ozark Merchant Services is building strong, personal relationships with his clients. Rather than seeing payment processing as a transactional service, Herron views himself as a consultant and partner in his clients’ success. “I get to know them personally,” he said. “I’m a people person, and I like meeting people.”

This hands-on approach has earned Herron a loyal client base, with many business owners appreciating his transparency and willingness to go above and beyond. “I’ll do anything to help the business in whatever direction they need to go,” he said. That might mean recommending ways to save money on fees, advising on equipment options, or simply being available when a client needs help troubleshooting.

In an industry often criticized for its lack of transparency and customer service, Herron’s approach is refreshing. “There’s no contract, and I don’t lease equipment,” he said. “If they need something, I’m the person they deal with from start to finish.” Whether he’s helping a business save money or providing better customer service, Herron’s goal is always the same—to help businesses thrive.

For Herron, one of the most rewarding parts of his work is seeing the tangible impact he can have on small businesses. His success stories, like the gun store that went from paying $1,500 to just $20 a month, are proof that even small changes in payment processing can make a big difference.

Another example involves a local restaurant that had been overpaying for years without realizing it. “They had no idea they were getting charged extra fees,” Herron explained. After conducting a cost savings analysis, Herron was able to cut their processing fees in half, allowing the restaurant to reinvest that money back into their business.

It’s stories like these that drive Herron’s passion for what he does. “Those fees eat businesses alive,” he said. “If I can help eliminate them, it keeps more money in their pockets.”

Photo credit: Ozark Merchant Processing

While Ozark Merchant Services continues to grow, Herron hasn’t forgotten the original inspiration behind his entrepreneurial journey—his desire to give back to veterans. Having served in the military for over 10 years, Herron remains deeply committed to supporting fellow veterans, particularly those who are homeless or struggling.

In the future, he hopes to create a charity or organization dedicated to helping veterans in need. “I do want to open up my own charity for veterans, some way of giving back to veterans, especially homeless vet programs,” Herron shared.

For now, Herron’s focus is on growing Ozark Merchant Services and helping as many local businesses as possible. With his transparent approach, commitment to customer service, and genuine desire to make a difference, Herron is poised to continue making a positive impact on the business community in Arkansas and beyond.

As he looks to the future, Herron’s passion for helping others—whether they’re small business owners or veterans—remains at the heart of everything he does. Whether it’s lowering fees, building trust, or giving back to the community, Herron is a business owner who truly wants to make a difference.