Fraud and scams can happen to any business, but small businesses can be especially vulnerable. With limited resources and growing demands, it’s easy to overlook classic warning signs or assume you’re too small to be a target.

Unfortunately, scammers count on that. This is why building awareness and putting safeguards in place is essential to protect your business.

Know the Common Types of Business Fraud

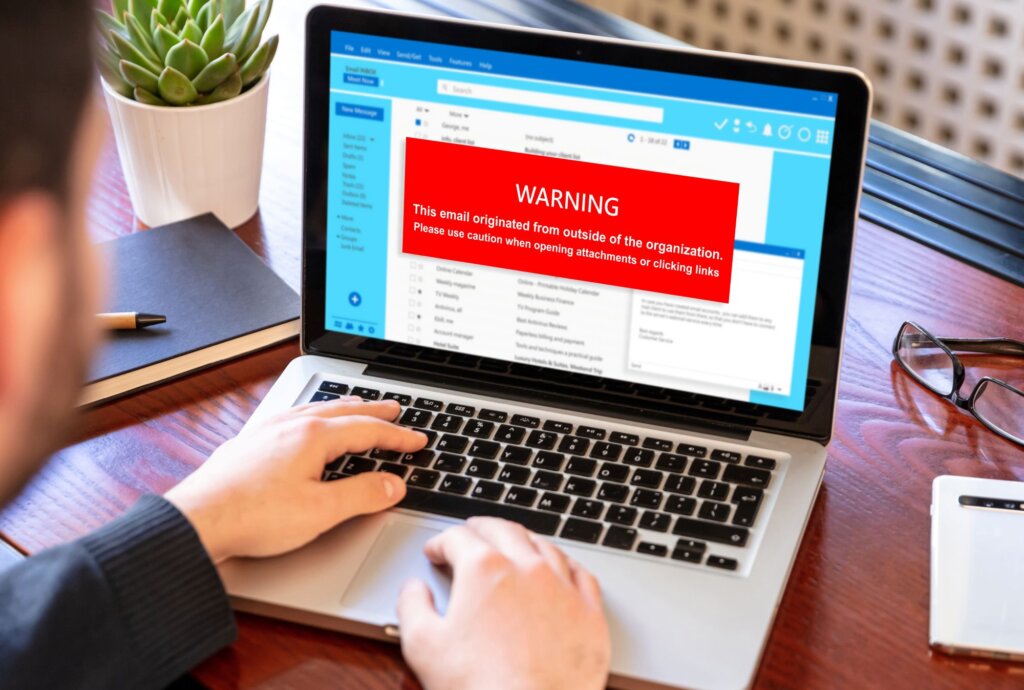

Understanding different types of scams is the first step when it comes to protecting your business. Here are a few of the most common that you might receive, especially by email:

- Phishing emails asking for sensitive information

- Fake invoices from vendors you’ve never worked with

- Overpayment scams where a customer “accidentally” sends too much and asks for a refund

- Impersonation scams pretending to be your bank, a utility provider, your accountant, or even another team member

Educating yourself and your team on how these scams typically unfold can help you recognize red flags. Even if the “from” email address looks legit, don’t click on any links you’re unsure about. Scammers can spoof email addresses and make links look incredibly convincing. Take a moment to scan for typos, consider the context of the email, and verify the information.

Strengthen Internal Controls

Even trusted employees can make mistakes. That’s why it’s important to have clear procedures and checks in place.

Use tools that track financial transactions, require dual approvals for large payments, and restrict access to sensitive data. If you work with contractors or part-time staff, be mindful of what systems and information they can access.

Verify Requests Before Taking Action

Always verify unusual or urgent requests, especially those related to wire transfers, login credentials, or changes in payment methods. Pick up the phone or use a verified email to confirm requests directly, especially if something feels off.

Bad actors rely on urgency and fear to make you ignore your better judgment. Take a minute to pause and verify before clicking on links or sending anything sensitive.

Invest in Cybersecurity

Good cybersecurity isn’t just for large corporations. Use strong, unique passwords, enable multi-factor authentication, and keep your software and systems up to date. Consider investing in antivirus protection and secure cloud-based tools for data storage. If you don’t have the time or resources to dedicate to proper cybersecurity, consider hiring a trusted local IT firm to do the heavy lifting for you.

Additionally, if you handle customer payment information, make sure your systems are PCI-compliant to meet data security standards.

Train Your Team

Everyone on your team should know how to spot and respond to suspicious activity. Host short training sessions or share resources that explain common scams and prevention strategies. When everyone knows what to watch for, your business becomes less of a target.

Fraud or scam attempts can strike at any time, but preparation makes a huge difference. With a few smart precautions and employee training, small businesses can strengthen their defenses and reduce their risk. Staying informed and proactive is the best way to keep your business safe.

This article is for informational purposes only and is not a substitute for professional cybersecurity advice.